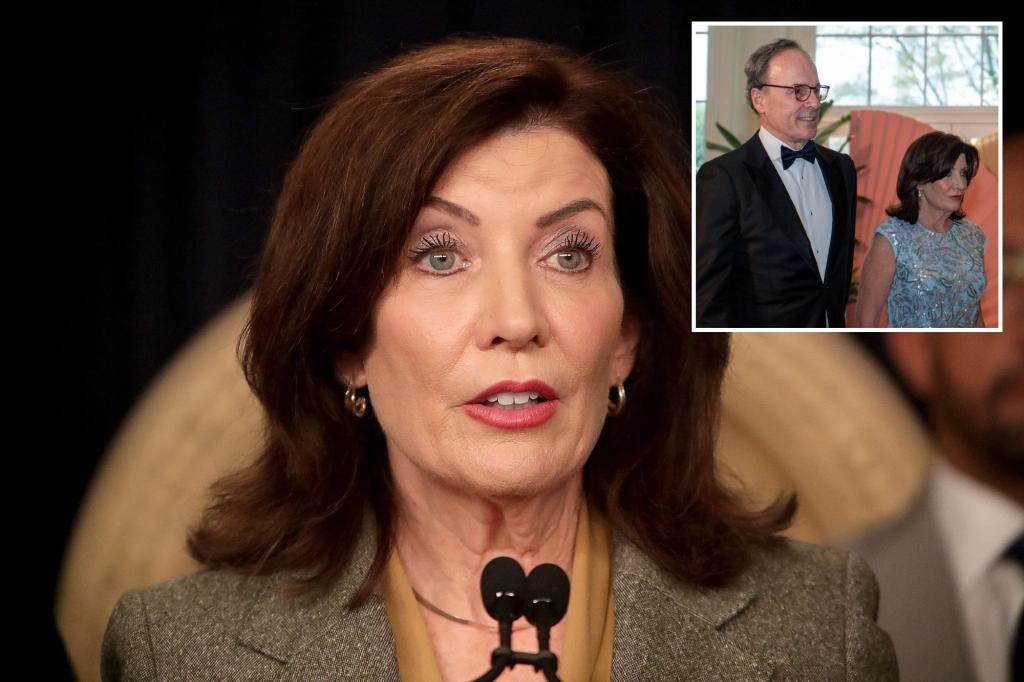

Governor Kathy Hochul and her husband, Bill, saw a substantial increase in their income in 2023, according to their recent tax return. Their adjusted gross income reached around million, a significant jump from the previous year’s million. The couple paid 0,000 in federal taxes and 3,090 in state taxes, with Bill Hochul being the primary earner, making approximately .5 million from his former employer, Delaware North, showing a significant increase from the 0,375 he earned in 2022.

In addition to their higher income, the Hochuls also ramped up their charitable contributions in 2023. They donated ,780 in stocks to various organizations, including shares of Microsoft to the Franciscan Sisters of St. Joseph in Hamburg, up from ,424 in charitable gifts in 2022. Bill Hochul claimed additional income in 2023, receiving ,579 in deferred payments from Delaware North and ,544 in pension payouts from his time as a federal prosecutor. The couple also benefited from an increase in dividends and interest paid.

While Governor Hochul’s office did not respond to requests for comment on their tax return, media reports highlight a significant increase in income and charitable donations by the Hochuls in 2023. Bill Hochul, in particular, experienced a boost in income from his former employer and claimed additional earnings from deferred payments and pension payouts.

The 2023 tax return for the Hochuls showcases not only their financial success but also their commitment to philanthropic efforts, with increased income, charitable contributions, and diversified sources of earnings. Despite not being required to disclose their tax returns publicly, the media reports shed light on the couple’s financial status, demonstrating their generosity and financial prosperity. Overall, the Hochuls’ tax return for 2023 reflects a notable increase in income, charitable giving, and additional sources of earnings compared to the previous year, underscoring their dedication to philanthropy and financial success.