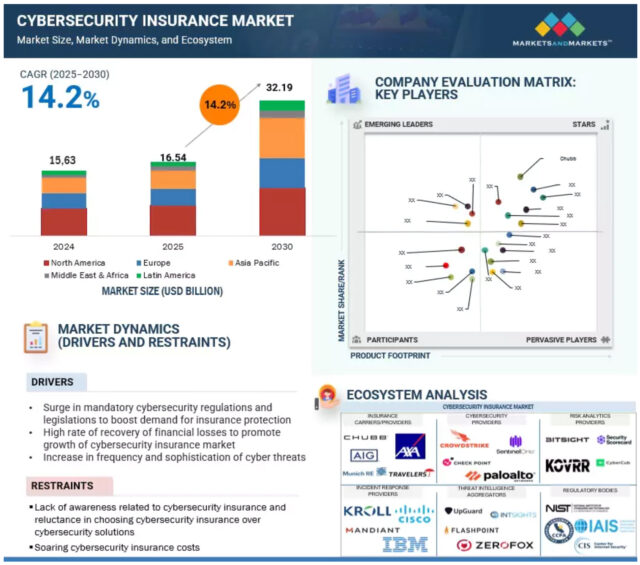

The global cybersecurity insurance market is expected to grow to $32.19 billion by 2030, up from $16.54 billion in 2025, according to a MarketsandMarkets report.

This growth, driven by a 14.2 percent Compound Annual Growth Rate (CAGR), reflects rising cyberrisks and increasing regulatory pressure forcing businesses to invest in digital risk protection.

SEE ALSO: Majority of cyber insurance ransomware claims are due to BEC

As cyberattacks grow more frequent and costly, companies of all sizes are turning to insurance not just for financial protection but also to meet compliance obligations.

Ransomware, data breaches, and phishing incidents have forced organizations to rethink how they manage risk. Alongside this, regulatory frameworks like GDPR in Europe, NIS2, and national laws across Asia and North America are pushing companies toward cybersecurity insurance as a compliance requirement.

This rising demand is especially visible among SMBs, which are now frequently targeted by attackers because, unlike large enterprises, they often lack in-house cybersecurity resources.

In response to this, insurers are rolling out bundled or packaged products that combine cyber coverage with traditional policies such as property or liability insurance. These products are designed to be affordable while including cyber endorsements that handle issues like ransom payments, data recovery, and legal support.

Packaged cybersecurity insurance is expected to grow at the fastest rate within the market.

These policies usually integrate cyber protections into existing insurance products. For example, a general liability policy may now include a cyber endorsement that helps cover losses resulting from hacking incidents. This approach appeals to businesses looking for comprehensive coverage in one plan.

Companies such as Chubb, CNA, AXIS Capital, Travelers, and Liberty Mutual are leading providers in this segment.

Cybersecurity risks are reshaping insurance priorities

Insurance providers themselves form the largest segment by provider type in the market forecast. As businesses that manage vast amounts of customer data and rely heavily on digital infrastructure, insurers face similar threats as their clients. They are also adopting cybersecurity insurance to manage risks related to data privacy, digital service continuity, and third-party dependencies.

To improve risk modeling and offer more tailored policies, many insurers are partnering with cybersecurity solution vendors like BitSight, RedSeal, Prevalent, and SecurityScorecard who supply the tools required to help assess an organization’s exposure and improve overall resilience.

Cyber insurance policies often come with added support, including access to specialized incident response teams, legal counsel, and PR services. These services can help policyholders manage the aftermath of a breach quickly and more effectively.

Beyond recovery support, policies increasingly include preventive services like security audits and training modules to helps insurers alleviate losses and reducing the risk of future client attacks.

Asia Pacific is forecast to post the fastest growth in the cybersecurity insurance market thanks to expanding cloud adoption, smart infrastructure, and mobile platforms, all of which make the region an attractive target for cybercriminals.

Businesses and governments are responding with new regulations, stricter data protection requirements, and increased penalties for non-compliance. This regulatory shift is creating demand for policies that can help companies align with laws while managing growing cyber threats.

Countries in Southeast Asia, Japan, South Korea, and India are all seeing expanded interest in cyber insurance. Global insurers such as AIG, Allianz, Zurich, and Chubb are actively expanding their products in these regions to meet the growing need.

Although North America and Europe currently lead the cybersecurity insurance market, APAC’s accelerating adoption of digital tools and shifting regulatory landscape is making it a critical growth zone.

As companies navigate these changes, insurers with regional expertise and partnerships with local tech vendors are positioned to benefit most.

What do you think about the growth of the cybersecurity insurance market? Let us know in the comments.

Image credit: denisismagilov/depositphotos.com